210 E. Earll Drive

Phoenix, AZ 85012

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under § 240.14a-12 |

Cable One, Inc. |

(Name of Registrant as Specified in Its Charter) |

(Name of Person(s) Filing Proxy Statement, if Other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

☒ | No fee required. |

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

(1) | Title of each class of securities to which the transaction applies: |

(2) | Aggregate number of securities to which the transaction applies: |

(3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

(4) | Proposed maximum aggregate value of the transaction: |

(5) | Total fee paid: |

☐ | Fee paid previously with preliminary materials. |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

(1) | Amount Previously Paid: |

(2) | Form, Schedule or Registration Statement No.: |

(3) | Filing Party: |

(4) | Date Filed: |

| 210 E. Earll Drive Phoenix, AZ 85012 |

March 28, 2017April 16, 2021

Dear Fellow Stockholders:

I am pleased to invite you to attendannounce the 2017details of the 2021 Annual Meeting of Stockholders (the “Annual Meeting”) of Cable One, Inc. (the “Company”). The Annual Meeting will be held at the Millenium Hilton, 55 Church Street, New York, New York, 10007,Company’s headquarters, 210 E. Earll Drive, Phoenix, Arizona, 85012, on Tuesday,Friday, May 2, 2017,21, 2021, at 8:3000 a.m., local time. It will also be streamed via a live audio webcast available on our investor relations website at ir.cableone.net or by visiting https://services.choruscall.com/links/cabo210521.html.

We remain sensitive to the continuing public health concerns surrounding the COVID-19 pandemic. Accordingly, to support the well-being of our associates and stockholders, we are recommending that you join the webcast rather than attending the Annual Meeting in person this year. We are actively monitoring the pandemic and vaccine distributions rates as well as the protocols that Federal, state and local governments may impose. In the event that we are required, or determine it is prudent, to restrict in-person attendance to the Annual Meeting, we will make an announcement as promptly as practicable in advance of the Annual Meeting via a press release that will be posted on our investor relations website and will also be filed with the Securities and Exchange Commission as additional proxy materials.

Included with this letter are a Notice of Annual Meeting of Stockholders and Proxy Statement, which describe the business to be conducted at the Annual Meeting.

Your vote is important. Whether or notAs always, we encourage you plan to attend the Annual Meeting, we hope you will vote your shares as soon as possible.possible prior to the Annual Meeting. You may vote over the Internet,internet as well as by telephone, or, if you requested to receive printed proxy materials, by returning a proxy card or voting instruction form in the envelope provided. If you plan to attend the Annual Meeting, kindly so indicate in the space provided on the proxy card or when prompted if voting over the Internet or by telephone.

Sincerely,

/s/ Thomas O. MightJulia M. Laulis

Thomas O. MightJulia M. Laulis

Executive Chairman and

ChairmanChair of the Board, President and

Chief Executive Officer

CABLE ONE, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

May 2, 201721, 2021

The 20172021 Annual Meeting of Stockholders of Cable One, Inc. (the “Company”) will be held at the Millenium Hilton, 55 Church Street, New York, New York, 10007,Company’s headquarters, 210 E. Earll Drive, Phoenix, Arizona, 85012, on Tuesday,Friday, May 2, 2017,21, 2021, at 8:3000 a.m., local time, for the following purposes:

1. | To elect |

2. | To ratify the appointment of PricewaterhouseCoopers LLP as the independent registered public accounting firm of the Company for the year ending December 31, |

3. | To approve, on a non-binding advisory basis, the compensation of |

4. |

|

|

|

| To transact such other business as may properly come before the meeting or any adjournment thereof. |

The Board of Directors of the Company has fixed the close of business on March 10, 2017,April 5, 2021 as the record date for the determination of stockholders entitled to notice of and to vote at the meeting.

It is important that your shares be represented and voted at the meeting. Please sign and return your proxy card or voting instruction form at your earliest convenience. You may also vote your shares by telephone or over the Internet.internet. If you choose to vote your shares by telephone or over the Internet,internet, please follow the instructions in the enclosed Proxy Statement and proxy card.card or voting instruction form. You may revoke your proxy at any time before it has been voted at the meeting. You may vote in person at the meeting even if you have previously given your proxy. For shares held through a broker, bank or other nominee, you may vote by submitting voting instructions as provided by your broker, bank or other nominee; however, you may not vote such shares in person at the meeting unless you have a proxy executed in your favor by your broker, bank or other nominee.

By Order of the Board of Directors,

/s/ Alan H. SilvermanPeter N. Witty

Alan H. SilvermanPeter N. Witty

Secretary

Phoenix, Arizona

March 28, 2017April 16, 2021

| |

PROPOSAL 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |

PROPOSAL 3: ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION FOR | |

| |

| |

| |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | |

| |

STOCKHOLDER PROPOSALS FOR THE | |

|

CABLE ONE, INC.

210 E. Earll Dr.

Phoenix, Arizona 85012

FOR THE 201SUMMARY7 ANNUAL MEETING OF STOCKHOLDERS

May 2, 2017

This Proxy Statement contains information relating to the 2017 Annual Meeting of Stockholders (the “Annual Meeting”) of Cable One, Inc. (the “Company, “we,” “us,” “our,” or “Cable ONE”) to be held at the Millenium Hilton, 55 Church Street, New York, New York, 10007, on Tuesday, May 2, 2017, at 8:30 a.m., local time, or any adjournments thereof, for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders. The Board of Directors (the “Board”) of the Company is making this proxy solicitation.

Important Notice RegardingThis Proxy Summary highlights information described in more detail elsewhere in this Proxy Statement. It does not contain all of the Availability ofinformation that you should consider, and you should read the entire Proxy Materials for the Annual Meeting of Stockholders

to Be Held on May 2, 2017Statement carefully before voting.

Our Proxy Statement and Annual Report to Stockholders are available at

Cable One, Inc. 2021 Annual Meeting of Stockholders (the “Annual Meeting”) Date and Time: Friday, May 21, 2021, at 8:00 a.m., local time Place: Cable One, Inc. Headquarters, 210 E. Earll Drive, Phoenix, Arizona, 85012 Webcast: ir.cableone.net or https://services.choruscall.com/links/cabo210521.html Record Date: April 5, 2021www.proxyvote.com

These proxy solicitation materials, including this Proxy Statement and the accompanying proxy card or voting instruction form, were first distributed and made available on or about March 28, 2017April 16, 2021 to all stockholders entitled to vote at the Annual Meeting.

QUESTIONS AND ANSWERS

|

|

|

|

The Board of Directors (the “Board”) of Cable One, Inc. (the “Company, “we,” “us,” “our” or “Cable One”) unanimously recommends you vote as follows:

Proposal |

| Page for Additional Detail | |||

1. Election of Directors: The election of |

each nominated director ☑ | 10 | ||||

2. Ratification of Appointment of Independent Registered Public Accounting Firm: The ratification of the Audit Committee’s appointment of PricewaterhouseCoopers LLP (“PwC”) as the independent registered public accounting firm of our Company for the year ending December 31, | FOR ☑ | 21 | |||

3. Advisory Vote to Approve Executive Compensation for 2020: The approval, on a nonbinding advisory basis, of the compensation of our named executive officers (“NEOs”) for 2020 (also referred to as the “say-on-pay” vote) | FOR ☑ | 46 |

Company Highlights |

Operational Highlights

■ | We added a record 82,000 residential data customers, which excluded a net of approximately 14,000 additional residential data customers from our acquisition and disposition activity in 2020. That growth resulted in an organic addition (excluding customers added at the time of closing of each of our various acquisitions since 2015) of over 50% more customers in 2020 than we had in the four-and-a-half year period between our spin-off and the end of 2019. |

■ |

|

| ○ | Participated in the Federal Communications Commission’s (the “FCC”) “Keep Americans Connected Pledge”; | |

| ○ | Creation of video chat applications that enabled our technicians to install and troubleshoot service while keeping our customers and employees safe; | |

| ○ | Setting up free public Wi-Fi hotspots and offering a low-cost 15 Megabit per second residential data service for the first three months; | |

| ○ | Member of the |

| ○ | Donated $300,000 to Meals on |

■ |

|

■ |

|

In the event that any nominee for election withdraws or for any reason is not able to serve as a director, Kevin P. Coyle and Alan H. Silverman, acting as your proxies, may vote for such other person as the Board may nominate.Financial Highlights

■ | Net income was $304.4 million in 2020, an increase of 70.4% year-over-year. Adjusted EBITDA was $674.1 million, an increase of 18.5% year-over-year. See Annex A of this Proxy Statement, entitled “Use of Non-GAAP Financial Measures,” for the definition of Adjusted EBITDA and a reconciliation of Adjusted EBITDA to net income, which is the most directly comparable measure under generally accepted accounting principles in the United States (“GAAP”). | |

■ | Net cash provided by operating activities was $574.4 million, an increase of 16.8% year-over-year. Adjusted EBITDA less capital expenditures was $380.9 million, an increase of 24.2% year-over-year. See Annex A of this Proxy Statement, entitled “Use of Non-GAAP Financial Measures,” for the definition of Adjusted EBITDA less capital expenditures and reconciliations to net income and net cash provided by operating activities, as applicable, which are the most directly comparable measures under GAAP. | |

■ | Total stockholder return as of December 31, 2020 was 50.4% on a one-year basis and 48.0% on a compounded three-year basis. |

|

■ |

| |

|

| |

■ | We are in the process of declassifying our Board over a three-year phase-in period after our stockholders, upon the unanimous recommendation of our Board, approved the elimination of our classified Board structure to provide for the annual election of directors at our 2020 Annual Meeting of Stockholders. | |

■ | We maintain robust executive and non-employee director stock ownership guidelines. | |

■ | Our Clawback Policy allows for the forfeiture and recoupment of incentive compensation in the event of financial restatements, legal or compliance violations and various forms of misconduct. | |

■ | We prohibit hedging and pledging of our securities by all executives, directors and other members of our restricted trading population. | |

■ | We have a majority voting requirement in uncontested director elections. | |

■ | We do not have a stockholder rights plan. | |

■ | Every member of our Audit, Compensation and Nominating and Governance Committees are independent under New York Stock Exchange (“NYSE”) listing standards and applicable Securities and Exchange Commission (“SEC”) rules. |

Proposal 1: Election of Directors (page 10) |

The following tables present certain information, as of April 5, 2021, concerning each nominee for election as a director at, and each director whose term of office will continue after, the Annual Meeting.

Director Nominees | ||||||||||||

Name | Age | Director Since | Principal Occupation | Independent | Committee Memberships | Other Public Company Boards | ||||||

Thomas S. Gayner | 59 | 2015 | Co-Chief Executive Officer of Markel Corporation | ✔ Independent Director) | Executive; Nominating and Governance | 3 | ||||||

Deborah J. Kissire | 63 | 2015 | Retired Ernst & Young LLP partner | ✔ | Audit | 3 | ||||||

Thomas O. Might | 69 | 1995 | Retired Executive Chairman of Cable One | ✔ | — | 0 | ||||||

Kristine E. Miller | 57 | 2019 | Former Senior Vice President, Chief Strategy Officer of eBay | ✔ | Compensation; Nominating and Governance | 0 | ||||||

| Class I and II Directors Continuing in Office | ||||||||||||

Name | Age | Director Since | Principal Occupation | Independent | Committee Memberships | Other Public Company Boards | ||||||

Brad D. Brian | 68 | 2015 | Chair of the law firm Munger, Tolles & Olson LLP | ✔ | Compensation; Nominating and Governance | 0 | ||||||

Julia M. Laulis | 58 | 2017 | Chair of the Board, President and Chief Executive Officer of Cable One | Executive | 1 | |||||||

Mary E. Meduski | 62 | 2019 | President and Chief Financial Officer of TierPoint, LLC and Cequel III, LLC | ✔ | Audit; Nominating and Governance | 0 | ||||||

Sherrese M. Smith | 49 | 2020 | Partner at the law firm Paul Hastings LLP | ✔ | Nominating and Governance | 1 | ||||||

Wallace R. Weitz | 71 | 2015 | Founder of Weitz Investment Management, Inc. | ✔ | Compensation; Executive | 1 | ||||||

Katharine B. Weymouth | 54 | 2015 | Former Publisher and Chief Executive Officer of Graham Holdings Company (“GHC”) | ✔ | Audit; Compensation | 2 | ||||||

Proposal 2: Ratification of Appointment of Independent Registered Public Accounting Firm (page 21) |

The following table provides summary information regarding the aggregate fees billed to the Company for professional services rendered by PwC for 2020 and 2019.

2020 | 2019 | |||||||

Audit Fees | $ | 2,639,156 | $ | 2,675,539 | ||||

Audit-Related Fees | 15,453 | 16,000 | ||||||

Tax Fees | — | — | ||||||

All Other Fees | 2,700 | 4,000 | ||||||

Total | $ | 2,657,309 | $ | 2,695,539 | ||||

Executive Compensation (page 23) |

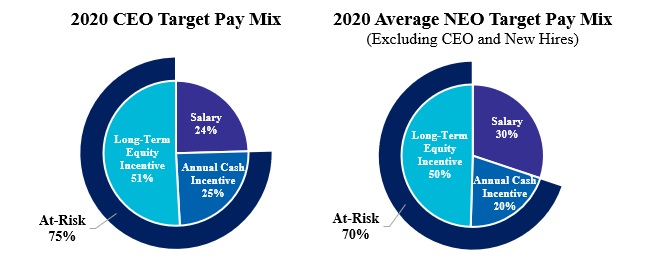

We have a performance-based compensation philosophy, and the key objectives of our executive compensation program are as follows:

■ | Attract and retain highly qualified and productive executives. |

■ |

|

■ | Align the long-term interests of our executives and stockholders through meaningful ownership of our stock by executives and by rewarding stockholder value creation. |

■ | Ensure that total compensation opportunities are competitive. |

The following charts show the components of 2020 target total direct compensation for our CEO and our other NEOs (except one newly hired NEO) and the percentage that is at-risk.

Proposal 3: Advisory Vote to Approve Executive Compensation for

|

We are asking stockholders to approve an advisory resolution on the compensation of our NEOs as reported in this Proxy Statement. Although the say-on-pay vote is advisory and therefore non-binding, the Board and the Compensation Committee value the input of our stockholders and will review and consider the voting results when making future decisions regarding our executive compensation program. At our 2020 Annual Meeting of Stockholders, nearly 99% of the votes cast were in favor of our say-on-pay proposal.

Who Can Vote |

Stockholders of record as of the close of business on April 5, 2021 (the “Record Date”) may vote at the Annual Meeting. Each of your shares—whether held (i) directly in your name as stockholder of record or (ii) in street name—entitles you to one vote with respect to each proposal to be voted on at the Annual Meeting. However, street name stockholders generally cannot vote their shares directly and instead must instruct the broker, bank or nominee how to vote their shares.

| How to Cast Your Vote | ||||||

| You can vote using any of the following methods: | ||||||

| Over the internet at www.proxyvote.com or scan the QR code on your proxy card or voting instruction form with your mobile device. We encourage you to vote this way. |

|

| |||

| By toll-free telephone at 1-800-690-6903. |

|

| |||

| By completing and mailing your proxy card or voting instruction form. |

|

| |||

|

|

| ||||

|

|

| ||||

FOR THE 2021 ANNUAL MEETING OF STOCKHOLDERS

MAY 21, 2021

This Proxy Statement contains information relating to the Annual Meeting of Cable One, or any adjournments thereof, for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders. The Board knowsis making this proxy solicitation.

Important Notice Regarding the Availability of no reason that would cause any director nominee Proxy Materials for the Annual Meeting of Stockholders

to be unableBe Held on May 21, 2021

Our Proxy Statement and Annual Report to act or to refuse to accept his or her nomination or election.Stockholders are available at

www.proxyvote.com

Other Questions and Answers

Q: | Will any other matters be voted on? |

A: | We are not aware of any matters to be voted on other than those referred to in this Proxy Statement. If any other matter is properly brought before the Annual Meeting, |

Q: |

|

A: | If you hold shares in “street name” (that is, your shares are held in a brokerage account by a broker, bank or other nominee, also known as a “beneficial owner”), you should follow the voting instructions provided by your broker, bank or other nominee. If you wish to vote over the internet or by telephone, your vote must be received by 11:59 p.m., Eastern Time, on the day before the Annual Meeting. After that time, internet and telephone voting will not be permitted, and a stockholder of record wishing to vote who has not previously submitted a signed proxy card or voting instruction form must vote in person at the Annual Meeting. Stockholders of record will be on a list held by the inspector of elections. Street name stockholders must obtain a proxy executed in their favor from the institution that holds their shares, whether it is their brokerage firm, bank or other nominee, and present it to the inspector of elections in order to vote at the Annual Meeting. Voting in person by a stockholder at the Annual Meeting will replace any previous votes submitted by proxy. Your shares will be voted as you indicate. If you are a stockholder of record |

|

|

|

|

|

|

|

If you hold shares in “street name” (that is, your shares are held in a brokerage account by a broker, bank or other nominee, also known as “beneficial owners”), you should follow the voting instructions provided by your broker, bank or other nominee.

If you wish to vote over the Internet or by telephone, your vote must be received by 11:59 p.m., Eastern Time, on the day before the Annual Meeting. After that time, Internet and telephone voting will not be permitted, and a stockholder of record wishing to vote who has not previously submitted a signed proxy card must vote in person at the Annual Meeting. Stockholders of record will be on a list held by the inspector of elections. Street name stockholders must obtain a proxy executed in their favor from the institution that holds their shares, whether it is their brokerage firm, bank or other nominee, and present it to the inspector of elections in order to vote at the Annual Meeting. Voting in person by a stockholder at the Annual Meeting will replace any previous votes submitted by proxy.

Your shares will be voted as you indicate. If you do not indicate your voting preferences, Kevin P. Coyle and Alan H. Silverman, acting as your proxies, will vote your shares in accordance with the Board’s recommendations specified above under “What are the voting recommendations of the Board?”

|

|

|

|

Q: | Can I change my vote? |

A: | Yes. If you are a stockholder of record, you can change your vote or revoke your proxy at any time before the Annual Meeting: |

■ | By entering a new vote over the |

■ | By returning a properly signed proxy card with a later date that is received at or prior to the Annual Meeting; or |

■ | By voting in person at the Annual Meeting. |

If you hold shares in street name, you may submit new voting instructions by contacting your bank, broker or other nominee. You may also change your vote or revoke your voting instructions in person at the Annual Meeting if you obtain a signed proxy from the record holder (bank, broker or other nominee) giving you the right to vote the shares. Only the latest validly executed proxy that you submit will be counted. |

Q: | What is a broker non-vote? |

A: | If you hold your shares in street name and do not provide voting instructions to your broker, NYSE rules grant your broker discretionary authority to vote your shares on “routine matters” at the Annual Meeting, including for the ratification of PwC as our independent registered public accounting firm for 2021 in Proposal 2. However, the proposals regarding the election of directors and say-on-pay are not considered “routine matters.” Furthermore, some brokers are electing to not exercise the discretionary authority granted to them pursuant to NYSE rules when they have not received instructions from their street name holders. As a result, if you hold your shares in street name and do not provide voting instructions to your broker, your shares: |

■ | will be voted on Proposal 2 if your broker chooses to exercise its discretionary authority to vote your shares and will not be voted on Proposals 1 and 3 (resulting in a “broker non-vote” with respect to each of those proposals); or |

■ | will not be voted on Proposal 2 if your broker chooses to not exercise its discretionary authority to vote your shares (resulting in your shares not being represented at the Annual Meeting). |

“Broker non-votes” will be counted as present for purposes of determining a quorum and will have no effect on Proposals 1 and 3. Therefore, we urge you to promptly provide voting instructions to your broker or other nominee so that your shares are voted on all proposals. |

Q: | What vote is required to approve a proposal? |

A: |

|

Proposal | Vote Required for Approval | Effect of Abstentions | Effect of Broker Non- Votes | |||

1. Election of Directors | Receipt of a majority of the votes cast at the Annual Meeting, | No effect | No effect | |||

2. Ratification of | Affirmative vote of a majority of the | No effect | No effect (brokers have discretion to vote on this proposal) | |||

3. Advisory Vote to Approve Executive Compensation for 2020 | Affirmative vote of a majority of the | No effect | No effect |

Regarding Proposal 1 (election of the Company’s directors), in accordance with our By-laws, any incumbent director who fails to receive a majority of the votes cast must submit an offer to resign from the Board no later than two weeks after the Company certifies the voting results. In that case, the remaining members of the Board would consider the resignation offer and may either (i) accept the offer or (ii) reject the offer and seek to address the underlying cause(s) of the majority-withheld vote. The Board must decide whether to accept or reject the resignation offer within 90 days following the certification of the stockholder vote, and, once the Board makes its decision, the Company must promptly make a public announcement of the Board’s decision (including a statement regarding the reasons for its decision in the event the Board rejects the offer of resignation).

Q: | What happens if a director nominee who is duly nominated does not receive a majority of the votes cast? |

A: | In accordance with our By-laws, any incumbent director who fails to receive a majority of the votes cast must submit an offer to resign from the Board no later than two weeks after the Company certifies the voting results. In that case, the remaining members of the Board will consider the resignation offer and may either (i) accept the offer or (ii) reject the offer and seek to address the underlying cause(s) of the majority-against vote. The Board must decide whether to accept or reject the resignation offer within 90 days following the certification of the stockholder vote, and, once the Board makes its decision, the Company must promptly make a public announcement of the Board’s decision (including a statement regarding the reasons for its decision in the event the Board rejects the offer of resignation). |

Q: | Who will count the vote? |

A: |

|

Q: | Where can I find the voting results of the Annual Meeting? |

A: | We will report the voting results in a Current Report on Form 8-K filed with the SEC within four business days following the Annual Meeting. |

Q: | Who can attend the Annual |

A: |

As we remain sensitive to the continuing public health concerns surrounding the COVID-19 pandemic and to support the well-being of our employees and stockholders, we are recommending that you join the webcast rather than attending the Annual Meeting in person this year. We are actively monitoring the pandemic and vaccine distributions rates as well as the protocols that Federal, state and local governments may impose. Except in the event that we are required, or determine it is prudent, to restrict in-person attendance at the Annual Meeting, all stockholders of record as of the close of business on If you join the live audio webcast, you will not be able to vote nor will your presence be counted for purposes of determining whether a quorum is present at the Annual Meeting. Accordingly, you are encouraged to vote in advance of the Annual Meeting over the internet, by toll-free telephone or by completing and mailing your proxy card or voting instruction form, as indicated above. In addition, stockholders and other interested parties listening via the live audio webast will not be able to pose questions. |

Q: | What do I need to do to attend the Annual Meeting? |

A: |

|

In addition, please follow these instructions:

|

Backpacks, cameras, recording equipment and other electronic recording devices will not be permitted inside the Annual Meeting. Failure to |

|

|

Seating at the Annual Meeting will be on a first-come, first-served basis upon arrival at the Annual Meeting.

Backpacks, cameras, cell phones with cameras, recording equipment and other electronic recording devices will not be permitted inside the Annual Meeting. Failure to follow the Annual Meeting rules or permit inspection will be grounds for exclusion from the Annual Meeting.

Q: | Can I bring a guest? |

A: | No. |

Q: | What is the quorum requirement of the Annual Meeting? |

A: | A majority of the votes entitled to be cast by the outstanding shares of common stock entitled to vote generally on the business properly brought before the Annual Meeting must be present in person or by proxy to constitute a quorum for the Annual Meeting. If you vote, your shares will be part of the quorum. Abstentions and “broker non-votes” will be counted for purposes of determining whether a quorum is present at the Annual Meeting. As of the Record Date, there were

|

Q: | Who is soliciting |

A: | Solicitation of proxies is being made by our management on behalf of the |

Q: | What other information about Cable |

A: | The following information is available: |

■ |

|

■ | In addition, printed copies of these documents will be furnished without charge (except exhibits) to any stockholder upon written request addressed to |

■ | Amendments to, or waivers granted to |

Q: | Can I receive materials relating to the Annual Meeting electronically? |

A: | To assist |

PROPOSAL 1: ELECTION OF DIRECTORS

TheOur Board is currently divided into three classes, designated Class I, Class II and Class III. Directors are elected by class forIII, with staggered three-year terms, which continue untilsuch that the thirdterm of one class expires at each annual meeting of stockholders. At our 2020 Annual Meeting of Stockholders, our stockholders approved our Amended and Restated Certificate of Incorporation (the “Charter”) to declassify the Board beginning with the Annual Meeting and provide for the annual election of all directors phased in over a three-year period. In accordance with this phase-in period, the nominees listed below and at each subsequent annual meeting are being proposed for election to one-year terms (until the first annual meeting of stockholders next following the director’s election and until the director’s successor is elected and qualified.qualified). As a result, our Board will be fully declassified following our 2023 Annual Meeting of Stockholders. Our Amended and Restated Certificate of Incorporation (“Charter”)Charter and By-laws provide that the number of the directors of the Company will be fixed from time to time by the Board.

There are threefour Class IIIII directors whose term of office expires in 2017.2021. The nominees for election as Class II directors, to serve for a three-yearone-year term until the 2020 annual meeting2022 Annual Meeting of stockholdersStockholders and until histheir successor is elected and qualified, are Alan G. SpoonThomas S. Gayner, Deborah J. Kissire, Thomas O. Might, and Wallace R. Weitz.Kristine E. Miller. All nominees are currently directors of the Company and were previously elected by the then-sole stockholder of the Company, Graham Holdings Company (“GHC”), at the effective time of the Company’s spin-off from GHC (the “spin-off”). Naomi M. Bergman will not stand for re-election at the conclusion of her term of office in 2017, and the size of the Board will be fixed at eight directors effective immediately upon the conclusion of Ms. Bergman’s term.Company.

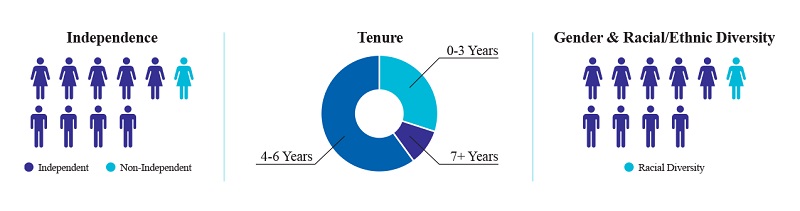

The candidates for election have been nominated by the Board based on the recommendation of the Nominating and Governance Committee. In choosing directors and nominees, the Company seeks individuals of the highest personal and professional ethics, integrity, and business acumen who are committedand commitment to representing the long-term interests of our stockholders.stockholders and other stakeholders. In respect of its composition, the Board considers the diversity, skills and experience of prospective nominees in the context of the needs of the Board and seeks directors who are “independent” under applicable law and listing standards. Although the Company’sour Corporate Governance Guidelines and the Policy Statement do not prescribe specific standards regarding Board diversity, the Board considers, as a matter of practice, the diversity of prospective nominees (including incumbent directors), both culturally and in terms of the variety of viewpoints on the Board, which may be enhanced by a mix of different professional and personal backgrounds and experiences. While diversity and the variety of viewpoints, backgrounds and experiences represented on the Board are always considered, the Board believes that a prospective nominee should not be chosen nor excluded solely or principally because of factors such as race, creed, color, religion, national origin, sex/gender, affectional or sexual orientation, gender identity, age or disability.

The Board is committed to evaluating diverse candidates for every vacancy, and it will include women and persons of color in each candidate pool from which non-incumbent director nominees are selected, consistent with its past practice. Over the last two years, the Board has elected three new female directors, including one racially diverse director.

Directors are elected by the affirmative vote of a majority of the votes cast at the Annual Meeting. The Board knows of no reason that would cause any nominee to be unable to act or to refuse to accept his or hertheir nomination or election. In the event that any nominee for election withdraws or for any reason is not able to serve as a director, the individuals acting as your proxies may vote for such other person as the Board may nominate.

The following table presents certain information, as of March 10, 2017,April 5, 2021, concerning each nominee for election as a director at, and each director whose term of office will continue after, the Annual Meeting.

Name |

| Age |

| Director Since |

| Position |

| Expiration of Term as Director |

Mr. Thomas O. Might |

| 65 |

| 1995 |

| Executive Chairman, Chairman of the Board, and Director |

| 2018 |

Ms. Julia M. Laulis |

| 54 |

| 2017 |

| President, Chief Executive Officer, and Director |

| 2019 |

Mr. Brad D. Brian* |

| 64 |

| 2016 |

| Director |

| 2019 |

Mr. Thomas S. Gayner* |

| 55 |

| 2016 |

| Lead Independent Director |

| 2018 |

Ms. Deborah J. Kissire* |

| 59 |

| 2016 |

| Director |

| 2018 |

Mr. Alan G. Spoon* |

| 65 |

| 2016 |

| Director |

| 2017 |

Mr. Wallace R. Weitz* |

| 67 |

| 2016 |

| Director |

| 2017 |

Ms. Katharine B. Weymouth* |

| 50 |

| 2016 |

| Director |

| 2019 |

Name | Age | Director Since | Current Class | Position | Expiration of Term as Director | |||||

Julia M. Laulis | 58 | 2017 | I | Chair of the Board, President and Chief Executive Officer | 2022 | |||||

Brad D. Brian* | 68 | 2015 | I | Director | 2022 | |||||

Thomas S. Gayner* | 59 | 2015 | III | Lead Independent Director | 2021 | |||||

Deborah J. Kissire* | 63 | 2015 | III | Director | 2021 | |||||

Mary E. Meduski* | 62 | 2019 | II | Director | 2023 | |||||

Thomas O. Might* | 69 | 1995 | III | Director | 2021 | |||||

Kristine E. Miller* | 57 | 2019 | III | Director | 2021 | |||||

Sherrese M. Smith* | 49 | 2020 | II | Director | 2023 | |||||

Wallace R. Weitz* | 71 | 2015 | II | Director | 2023 | |||||

Katharine B. Weymouth* | 54 | 2015 | I | Director | 2022 |

* Independent Director

In addition to the information presented below regarding each nominee’snominee’s specific qualifications, skills, attributes and experience that led the Board to conclude that he or she should serve as a director, the Board believes that each nominee has demonstrated established records of accomplishment in areas relevant to the Company’sour strategy and operations and share characteristics identified in the Company’sour Corporate Governance Guidelines, StatementCode of Ethical PrinciplesBusiness Conduct and Ethics and the Policy Statement as essential to a well-functioning deliberative body, including honesty, integrity, judgment, acumen, ethics, financial literacy, independence, competence, diligence and commitment to the interests of all stockholders to build long-term stockholder value.

All of the directors and nominees have held senior positions as leaders of complex organizations and gained expertise in core management skills, such as strategy and business development, innovation, line operations, brand management, finance, legal, compensation, and leadership development, compliance and risk management. They have significant experience in corporate governance and oversight through their positions as senior executives and as directors of public companies and other institutions. These skills and experience are pertinent to the Company’sour current and evolving business strategies, as well as to the Board’s oversight role, and enable the directors to provide diverse perspectives about the complex issues facing the Company.

The following matrix and biographies highlight specificsignificant qualifications, skills, attributes and experience of each of our directors who is a nominee for election as a director or whose term of office will continue after the Annual Meeting. The matrix is a summary only; therefore, it does not include all of the qualifications, skills, attributes and experience that each director offers, and the fact that a particular qualification, skill, attribute or experience is not listed does not mean that a director does not possess it.

Communications / Media Industry Experience | Leadership Experience | Governance / Outside Board Experience | Financial / Accounting Expertise | Legal Expertise | Diversity | ||||||||||||||

Brad D. Brian | ✔ | ✔ | ✔ |

|

| ||||||||||||||

Thomas S. Gayner | ✔ |

| ✔ |

|

|

| |||||||||||||

Deborah J. Kissire | ✔ | ✔ | ✔ |

|

|

|

| ||||||||||||

|

|

|

| ✔ | |||||||||||||||

Julia M. Laulis |

|

| ✔ | ✔ | ✔ |

| |||||||||||||

| ✔ |

| ✔ |

| ✔ | ||||||||||||||

Thomas O. Might |

| ✔ |

| ||||||||||||||||

Kristine E. Miller | ✔ | ✔ | ✔ | ||||||||||||||||

Sherrese M. Smith | ✔ | ✔ | ✔ | ✔ | ✔ | ||||||||||||||

Wallace R. Weitz | ✔ | ✔ | ✔ |

|

|

| |||||||||||||

Katharine B. Weymouth | ✔ |

| ✔ |

|

|

|

|

Nominees for Election for a Term Expiring at the 20202022 Annual Meeting of Stockholders

Alan G. SpoonThomas S. Gayner

Mr. Spoon is currently Partner Emeritus at Polaris Partners,Gayner has served as Co-Chief Executive Officer of Markel Corporation, a private investment firm that provides venture capital to development-stage companies.publicly traded financial holding company headquartered in Glen Allen, Virginia, since January 2016 and as a director since August 2016. He has been with Polaris Partners sincealso served as President and Chief Investment Officer of Markel Corporation from May 2000, previously serving2010 until December 2015 and as Managing General Partner and General Partner. Mr. Spoon was Chief Operating Officer and a director of The Washington Post CompanyMarkel Corporation from March 1991 through May 2000 and1998 to 2003. Since 1990, he has served as President of The Washington Post Company from September 1993 through May 2000. Prior to that,Markel-Gayner Asset Management Corporation. Previously, he heldwas a wide variety of positionscertified public accountant at The Washington Post Company, includingPwC and a Vice President of Newsweek from September 1989 to May 1991.Davenport & Company LLC in Virginia. Mr. Spoon began his career at, and later became a partner of, The Boston Consulting Group.

Mr. SpoonGayner serves on the boards of DanaherColfax Corporation Fortiveand GHC. He also serves on the board of The Davis Series Mutual Funds.

Mr. Gayner brings to the Board the leadership, management oversight and financial skills gained in his role as a senior manager and director of Markel Corporation IAC/InterActiveCorp and Match Group, Inc. and previously servedas well as other public company boards.

In considering the nomination of Mr. Gayner to serve an additional term as a director, the other members of the Nominating and Governance Committee (on which Mr. Gayner serves as Chair) and the Board carefully examined and assessed Mr. Gayner’s roles with and obligations to entities other than the Company, including his position as an executive officer of Markel Corporation and his services as a board member of other public companies, including our former corporate parent, GHC. Among the numerous benefits derived from Mr. Gayner’s service as a director, the Board believes that his experience, perspective and insights all strongly align with our long-term focus; his presence on and helping lead the Board provides stability and continuity in light of the shift in our strategic focus over the last decade to being a broadband-centric connectivity provider as well as in our evaluation, execution and/or integration efforts related to multiple acquisitions and strategic investments; and his deep understanding of and involvement with various stakeholders stemming from his roles at other companies provides a unique and valuable resource to Cable ONE from 1991One. The Nominating and Governance Committee and the Board also took note of Mr. Gayner’s perfect attendance record in 2019 and 2020 at meetings of the Board and of the Committees on which he served as well as his exceptional attendance record in his nearly six years of service on our Board (having attended all but two of his Board and Committee meetings during that time). Furthermore, Mr. Gayner has vigorously discharged his leadership roles as our Lead Independent Director and as Chair of the Executive and Nominating and Governance Committees, both in preparedness and active participation, and he continues to 2000. Additionally, hebe a valuable member of the Board with sufficient capacity to devote the necessary time and attention to matters concerning the Board. After a thorough evaluation of all of these considerations, as well as the leadership, management oversight and financial skills brought to the Board by Mr. Gayner, the Nominating and Corporate Governance Committee unanimously recommended and the Board unanimously re-nominated Mr. Gayner for election to the Board.

Deborah J. Kissire

Ms. Kissire retired as a partner of Ernst & Young LLP, an independent registered public accounting firm, in July 2015 after a 36-year career. At the time of her retirement, Ms. Kissire served as Ernst & Young’s Vice Chair and East Central Region Managing Partner as well as a member of the Americas Executive Board. Ms. Kissire serves on the boards of Axalta Coating Systems Ltd., Celanese Corporation and Omnicom Group Inc., and she has served on the boards of Getty Images, TechTarget, Inc., Human Genome Sciences, TicketmasterGoodwill Industries of Greater Washington and American Management Systems. Previously, Junior Achievement USA.

Ms. Kissire brings to the Board her significant experience in public company financial reporting, accounting and internal control matters.

Thomas O. Might

Mr. Spoon wasMight has been a member of the Board of Regents at the Smithsonian Institution (formerly Vice Chairman). He is a memberCable One since 1995. Prior to his retirement from Cable One in December 2017, Mr. Might served as Executive Chairman in 2017, as Chairman of the MIT Corporation (member of theBoard from 2015 to 2017, as Chief Executive Committee), where he also serves on the board of edX (an online education platform).Officer from 1994 to 2016 and as President from 1994 to 2014.

Mr. Spoon’s public company leadership experience gives him insight into business strategy, leadership and executive compensation, and his public company and private equity experience give him insight into technology trends, acquisition strategy and financing. With more than 20 years of experience withMight joined The Washington Post Company including nine years(now named Graham Holdings Company) in 1978 as assistant to publisher Donald E. Graham after serving a directorsummer internship at the newspaper in 1977. He was promoted to Vice President-Production in 1982 and served in that position until 1987, when he became Vice President-Production and Marketing. In 1991, Mr. Might was named Vice President-Advertising Sales. In 1993, Mr. Might was promoted to President and Chief Operating Officer of Cable ONE, he also has knowledgeOne. He became President and Chief Executive Officer of Cable ONE’s business.

Wallace R. WeitzOne in 1994 and was elected to the Board in 1995. Mr. Might was a Combat Engineer Officer in the U.S. Army from 1972 to 1976.

Mr. Weitz founded the investment management firm Weitz Investment Management, Inc. in 1983 as Wallace R. Weitz & Company and has since served in various roles at Weitz Investment Management, including Chief Investment Officer, President and Portfolio Manager. Mr. Weitz manages the Partners III Opportunity Fund and co-manages the Partners Value Fund and Hickory Fund, each of which is managed by Weitz Investment Management. Mr. Weitz has served as a Trustee of the Weitz Funds since 1986. Mr. Weitz began his career in New York as a securities analyst before joining Chiles, Heider & Co. in Omaha, Nebraska in 1973. There, he spent 10 years as an analyst and portfolio manager. Mr. Weitz is on the Board of Trustees for Carleton College and serves on various other non-profit boards.

Mr. WeitzMight brings to the Board leadership and management oversight skills as well as intimate knowledge and perspective about the Company’s history, strategic and operational opportunities and challenges, economic and industry trends, and the competitive and financial positioning of the Company based on his substantial finance experience as an investor in public companies.various executive roles at Cable One.

Kristine E. Miller

Ms. Miller served as Senior Vice President, Chief Strategy Officer for eBay, a global ecommerce marketplace, from September 2014 until February 2020. Prior to joining eBay, Ms. Miller was a Partner and Director at Bain & Company, a global management consulting firm, from 1990 until 2014. At Bain, Ms. Miller served in numerous leadership roles, including Chair of Bain’s Compensation and Promotion Committee. Ms. Miller currently serves on the boards of Neiman Marcus Group; Chairish, an online, high-end home furnishings marketplace; and Reflect, a privately held mental health platform. She has served on the boards of the eBay Foundation, Bain & Company, the California Chamber of Commerce and Junior Achievement of the Bay Area.

Ms. Miller brings to the Board her extensive experience, including working with company management and boards, on matters related to strategic leadership, marketing, technology, operations and organizational effectiveness across various industries as well as expertise related to acquisition and integration activities.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR”“FOR” THE ELECTION OF EACH OF THE NOMINATED DIRECTORS.

Directors Continuing in Office

Brad D. Brian

Mr. Brian is a Co-Managing Partner atnational trial lawyer and Chair of the California law firm Munger, Tolles & Olson LLP, having been with the firmpracticed there for over 30more than 39 years. A complex civil and criminal litigator, Mr. Brian is a Fellow in the American College of Trial Lawyers and the International Academy of Trial Lawyers. Mr. Brian has represented numerous Fortune 500 corporations in lawsuits and government investigations. This work has included trials, regulatory investigations and internal corporate investigations. He also has defended companies against more than 40 lawsuits filed under the qui tam provisions of the False Claims Act. Mr. Brian is the co-editor of Internal Corporate Investigations (ABA 3rd4th Ed. 2007)2017). Mr. Brian was named a “Litigator of the Year” by The American Lawyer in 2016. He serves on several non-profit boards, including the board of trustees of the UC Berkeley Foundation.

Mr. Brian brings to the Board his experience as a litigator and corporate advisor and his understanding of legal matters that may arise at Cable ONE.

Thomas S. Gayner

Mr. Gayner has served as Co-Chief Executive Officer of Markel Corporation, a publicly traded financial holding company headquartered in Glen Allen, Virginia, since January 2016 and as a director since August 2016. He also served as President and Chief Investment Officer of Markel Corporation from May 2010 until December 2015, and as a director of Markel Corporation from 1998 to 2003. Since 1990, he has served as President of Markel-Gayner Asset Management Corporation. Previously, he was a certified public accountant at PricewaterhouseCoopers LLP and a Vice President of Davenport & Company LLC in Virginia. Mr. Gayner serves on the boards of GHC, Colfax Corporation and The Davis Series Mutual Funds. He also serves on the boards of the non-profit entities Bon Secours Health System and the Community Foundation of Richmond.

Mr. Gayner brings to the Board the leadership, management oversight and financial skills gained in his role as a senior manager and director of Markel Corporation as well as other public company boards.

Deborah J. Kissire

Ms. Kissire retired as a partner of Ernst & Young LLP, an independent registered public accounting firm, in July 2015 after a 36-year career. At the time of her retirement, Ms. Kissire served as Ernst & Young’s Vice Chair and East Central Managing Partner as well as a member of the Americas Executive Board. Ms. Kissire serves on the boards of Axalta Coating Systems Ltd. and Omnicom Group Inc., and she has served on the boards of Goodwill Industries of Greater Washington and Junior Achievement USA.

Ms. Kissire brings to the Board her significant experience in public company financial reporting, accounting and financial control matters.One.

Julia M. Laulis

Ms. Laulis has been Chair of the Board since January 2018, Chief Executive Officer and a member of the Board since January 2017 and President of Cable ONEOne since January 2015.

Ms. Laulis joined Cable ONEOne in 1999 as Director of Marketing-NWMarketing – Northwest Division. In 2001, she was named Vice President of Operations for the SWSouthwest Division. In 2004, she accepted the additional responsibilitybecame responsible for starting up Cable ONE’sOne’s Phoenix Customer Care Center. In 2008, she was named Chief Operations Officer, and in 2012, she was named Chief Operating Officer of Cable ONE.Officer. In January 2015, she was promoted to President and Chief Operating Officer of Cable ONE.Officer.

Prior to joining Cable ONE,One, Ms. Laulis served in various senior marketing management positions with Jones Communications. Ms. Laulis began her 30-plus-year35-plus-year career in the cable industry with Hauser Communications.

Ms. Laulis serves on the boards of The AES Corporation, C-SPAN, CableLabs and The Cable Center, and she is a trustee of the C-SPAN Education Foundation.

In addition to being the Company’s President and Chief Executive Officer, Ms. Laulis brings to the Board her significant operational and leadership experience as well as intimate knowledge and perspective about the strategic and operational opportunities and challenges, economic and industry trends, and competitive and financial positioning of the Company based on her various executive roles at Cable ONE.One.

Thomas O.Mary E. MeduskiMight

Mr. Might has been Executive Chairman of Cable ONE since January 2017. HeMs. Meduski has served as ChairmanPresident and Chief Financial Officer and a director of TierPoint, LLC, a leading national provider of information technology and data center services, since December 2015. She also serves as President and Chief Financial Officer of Cequel III, LLC, TierPoint’s management company. Prior to joining TierPoint, Ms. Meduski served as Executive Vice President and Chief Financial Officer of Suddenlink Communications from 2006 until 2015. Before joining Suddenlink Communications, Ms. Meduski served as Executive Vice President and Chief Financial Officer of AAT Communications Corp., the Boardlargest privately owned wireless tower company in the United States at the time. Prior to joining AAT Communications, she was a Managing Director in the Media and Communications Investment Banking Groups of Cable ONE since 2015TD Securities and asBankBoston Securities. Ms. Meduski is a member of the Cornell University Board of Cable ONETrustees.

Ms. Meduski brings to the Board her significant leadership, financial and operating experience in the communications, media and technology industries.

Sherrese M. Smith

Ms. Smith has served as a corporate partner at Paul Hastings LLP since 1995. Mr. MightAugust 2013. She is a member of the firm’s media, technology and telecommunications practice and serves as Vice-Chair of the firm’s data privacy and cybersecurity practice. Prior to joining Paul Hastings, Ms. Smith served as Chief Executive OfficerCounsel to Chairman Julius Genachowski at the FCC from July 2009 to June 2013. She was Vice President and General Counsel of Cable ONE from 1994 to 2016 and as President of Cable ONE from 1994 to 2014.

Mr. Might joined The Washington Post Company in 1978 as assistantDigital from July 2002 to publisher Donald E. Graham after serving a summer internship at the newspaper in 1977. He was promoted to Vice President-Production in 1982 and served in that position until 1987, when he became Vice President-Production and Marketing. In 1991, Mr. Might was named Vice President-Advertising Sales.

In 1993, Mr. Might was promoted to President and Chief Operating Officer of Cable ONE (formerly named Post-Newsweek Cable). He became President and Chief Executive Officer of Cable ONE in 1994 and was elected to the Board in 1995.

Mr. MightJuly 2009. Ms. Smith serves on the boards of NortonLifeLock Inc., America’s Public Television Stations (APTS) and the American Cable Association, CableLabs, and C-SPAN. Mr. Might was a Combat Engineer Officer inPhilip Merrill College of Journalism at the U.S. Army from 1972 to 1976.University of Maryland.

Mr. Might

Ms. Smith brings to the Board leadershipher experience in counseling companies on complex transactional and management oversight skillsregulatory issues involving media, communications and technology companies, including regarding data privacy and cybersecurity, as well as intimate knowledgeher insights having previously served at the FCC.

Wallace R. Weitz

Mr. Weitz founded the investment management firm Weitz Investment Management, Inc. in 1983 as Wallace R. Weitz & Company and perspective abouthas since served in various roles at Weitz Investment Management, including Chief Investment Officer, President and Portfolio Manager. Mr. Weitz manages the strategicPartners III Opportunity Fund and operational opportunitiesco-manages the Partners Value Fund and challenges, economic and industry trends, and competitive and financial positioningHickory Fund, each of which is managed by Weitz Investment Management. Mr. Weitz has served as a Trustee of the Company basedWeitz Funds since 1986. Mr. Weitz began his career in New York as a securities analyst before joining Chiles, Heider & Co. in Omaha, Nebraska in 1973. There, he spent 10 years as an analyst and portfolio manager. Mr. Weitz is on the board of trustees for Carleton College and serves on various other non-profit boards.

Mr. Weitz brings to the Board his various executive roles at Cable ONE.substantial finance experience as an investor in public companies.

Katharine B. Weymouth

Ms. Weymouth was theserved as Publisher and Chief Executive Officer of The Washington Post, Media and Publisherthe newspaper division of The Washington Post newspaperCompany, from February 2008 until October 2014. She joinedPrior to becoming Publisher and Chief Executive Officer, Ms. Weymouth served in a number of different business roles at The Washington Post, Companyincluding as Vice President of the advertising department. She began her career as an attorney, practicing for eight years, including as a judicial clerk on the U.S. Court of Appeals for the 9th Circuit for one year, as a litigator at the law firm of Williams & Connolly LLP for several years and in 1996 as Assistant General Counsel ofthe legal department at The Washington Post newspaper and held various positions within that organization over the course of 18for multiple years. Ms. Weymouth held several positions within The Washington Post’s advertising department, including Directoris a Senior Advisor to dineXpert, a group buying service for independent restaurants, after having previously served in the roles of Chief Operating Officer and President. Ms. Weymouth serves on the department’s jobs unit, Directorboards of Advertising SalesGHC and Vice President of Advertising.Republic Services, Inc. She also servedserves as Associate Counsel of Washingtonpost.Newsweek Interactive, then the online publishing subsidiary of The Washington Post Company. Ms. Weymouth has been a director of GHC, from which Cable ONE was spun-off in July 2015, since September 2010. She serves asthe Sequoia Fund and at two private companies—Xometry and Empower. In addition, she is a Trustee oftrustee for the Philip L. Graham Fund, and of The Field School and is a directorthe Chair of the American Institute of Architects,Board for The Economic Club ofGreater Washington D.C. and the Community Foundation for the Greater Capital Region.and an Advisory Board member of FiscalNote.

Ms. Weymouth brings to the Board public company leadership, management oversight and operational expertise gained through her various senior roles with and directorshipdirectorships at public and private companies as well as historical knowledge of our business from her time as a director of GHC.

There are no family relationships among any of our directors and executive officers.

Board Committees and Meeting Attendance

The standing committees of the Board includeconsist of the Audit Committee, Compensation Committee, Executive Committee and Nominating and Governance Committee. As discussed in more detail below, each of the Audit, Compensation and Nominating and Governance Committees is comprised entirely of independent directors, consistent with the definition of “independent” under NYSE listing and SEC rules standards applicable to boards of directors generally and board committees in particular.

Each committee of the Board operates under a written charter that is maintained on our website, http://ir.cableone.net/govdocs, and has the authority to hire at the expense of the Company independent legal, accounting, compensation, financial or other advisors as it deems necessary or appropriate.

The following table summarizes the current membership of theour 10-person Board and each of its committees, as well as the number of times the Board and each committee met during 2016.2020.

Director |

| Board |

| Audit Committee |

| Compensation Committee |

| Executive Committee |

| Nominating and Governance Committee |

Thomas O. Might |

| Chair |

|

|

|

|

| ✓ |

|

|

Julia M. Laulis* |

| ✓ |

|

|

|

|

| ✓ |

|

|

Naomi M. Bergman** |

| ✓ |

| ✓ |

|

|

|

|

| ✓ |

Brad D. Brian |

| ✓ |

|

|

| ✓ |

|

|

| ✓ |

Thomas S. Gayner |

| Lead Independent Director |

|

|

|

|

| Chair |

| Chair |

Deborah J. Kissire |

| ✓ |

| Chair |

|

|

|

|

|

|

Alan G. Spoon |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

|

|

Wallace R. Weitz |

| ✓ |

|

|

| Chair |

|

|

|

|

Katharine B. Weymouth |

| ✓ |

|

|

|

|

|

|

|

|

Number of Meetings |

| 7 |

| 5 |

| 6 |

| 4 |

| 5 |

Director Board Audit Committee Compensation Committee Executive Committee Nominating and Governance Committee Brad D. Brian* ✔ ✔ ✔ Thomas S. Gayner* Lead Independent Director Chair Chair Deborah J. Kissire* ✔ Chair Julia M. Laulis Chair ✔ Mary E. Meduski* ✔ ✔ ✔ Thomas O. Might* ✔ Kristine E. Miller* ✔ ✔ ✔ Sherrese M. Smith* ✔ ✔ Wallace R. Weitz* ✔ Chair ✔ Katharine B. Weymouth* ✔ ✔ ✔ Number of Meetings 6 7 4 4 4 * Independent Director |

|

|

|

Each director attended at least 75% of the total number of meetings of the Board and the committees of the Board on which the director served during their term of service in 2016.2020.

As we are a part of the United States’ critical infrastructure, and our continued operation was and is essential to connectivity services that are vital during the COVID‐19 pandemic, during 2020, our Board members also regularly interacted on an informal basis to monitor the evolving situation caused by and the effects of the pandemic on our business and to review and discuss our responses to the pandemic to support the well-being of our employees, customers, suppliers, business partners and others.

Audit Committee

The functions of the Audit Committee include, among other duties, overseeing:

■ |

|

■ | the integrity of our financial statements; |

■ | our compliance with legal and regulatory requirements; |

■ | the qualifications and independence of our |

■ | the performance of our internal audit function; |

■ | the |

■ | the preparation of certain reports required by the rules and regulations of the |

The Board has determined that all members of the Audit Committee are non-employee, “financially literate,” “independent” directors within the meaning of the listing standards of the NYSE. All members of the Audit Committee have also been determined to be “independent” within the meaning of the SEC rules applicable to service on audit committees. None of the members of the Audit Committee has accepted, other than in such person’sperson’s capacity as a committeeBoard or Board committee member, any consulting, advisory or other compensatory fee from the Company or its affiliates.

The Board has determined that each of Ms.Mses. Kissire and Mr. SpoonMeduski has the requisite background and experience to be (and is)and was designated an “audit committee financial expert” within the meaning of Item 407(d)(5)(ii) of Regulation S-K due to his or hertheir extensive experience, as discussed under “Proposal 1: Election of Directors.” In addition, the Board has determined that all of the members of the Audit Committee are well grounded in financial matters and are familiar with generally accepted accounting principles.GAAP. All of the members of the Audit Committee have a general understanding of internal controls and procedures for financial reporting, as well as an understanding of audit committee functions. To the extent that matters come before the Audit Committee that involve accounting issues, the members of the Audit Committee consult with and rely on management, in addition to consulting with external experts, such as the Company’s independent registered public accounting firm, PricewaterhouseCoopers LLP.PwC. In addition, the Audit Committee has authority to obtain advice from internal or external legal or other advisors.

Compensation Committee

The functions of the Compensation Committee include, among other duties:

■ | determining and approving the compensation of our Chief Executive Officer; |

■ | reviewing and approving the compensation of our other |

■ | overseeing the administration and determination of awards under our compensation plans; |

■ | overseeing our human capital programs, policies and practices, such as associate development, talent management, organizational culture and diversity and inclusion initiatives (except with respect to matters that are within the scope of responsibility of another committee of the Board); and |

■ | preparing any report on executive compensation required by the rules and regulations of the SEC. |

All members of the Compensation Committee are non-employee directors and have been determined to be “independent” within the meaning of the listing standards of the NYSE and SEC rules applicable to service on compensation committees of emerging growth companies.committees.

Executive Committee

The functions of the Executive Committee include, among other duties:

■ | reviewing and providing guidance to the Board and to senior management of the Company regarding the |

■ | performing such other duties or responsibilities as may be delegated to the Committee from time to time by the Board. |

Nominating and Governance Committee

The functions of the Nominating and Governance Committee include, among other duties:

■ | overseeing our corporate governance practices; |

■ | reviewing and recommending to our Board amendments to our By-laws, Charter, committee charters and other governance policies; |

■ | reviewing and making recommendations to our Board regarding the structure of our various board committees; |

■ | identifying, reviewing and recommending to our Board individuals for election to the Board; |

■ | adopting and reviewing policies regarding the consideration of candidates for our Board proposed by stockholders and other criteria for membership on our Board; |

■ | overseeing the Chief Executive Officer succession planning process, including an emergency succession plan; |

■ | reviewing the leadership structure for our Board; |

■ | overseeing our |

■ | overseeing and monitoring general governance matters, including communications with stockholders and regulatory developments relating to corporate governance. |

All members of the Nominating and Governance Committee are non-employee directors and have been determined to be “independent” within the meaning of the listing standards of the NYSE.

Corporate Governance Guidelines and CodesCode of Business Conduct and Ethics

In order to help assure the highest levels of business ethics at Cable ONE,One, our Board has adopted the following Corporate Governance Guidelines and codesa Code of conduct,Business Conduct and Ethics, which are maintained on our website, http://ir.cableone.net/govdocs.

Corporate Governance Guidelines

Our Corporate Governance Guidelines provide a framework for the governance of the Company. Among other things, our Corporate Governance Guidelines addressaddress: director qualifications,qualifications; Board operations, structure and leadership; director compensation,compensation; management review and succession,succession; and director orientation and continuing education. The Corporate Governance Guidelines also provide for annual self-evaluations by the Board and its committees.

The Board has not established limits on the number of terms a director may serve prior to his or hertheir 75th birthday; however, no director may be nominated to a new term if he or she would be age 75 or older at the time of the election.election, unless the Board, upon recommendation of the Nominating and Governance Committee, determines that it is in the best interests of the Company and its stockholders for the director to continue to serve on the Board for an additional term.

Code of Business Conduct and Ethics

Our Code of Business Conduct and Ethics applies to our employees, including any employee directors.directors, officers and employees. The Code of Business Conduct and Ethics is designed to deter wrongdoing and contains policies pertaining to, among other things, employee conductcompliance with applicable laws, rules and regulations; the responsible use of and control over our assets and resources; the integrity of records, reports and financial statements; political contributions and activities; anti-bribery and anti-corruption laws; conflicts of interest and corporate opportunities; employment matters, including equal employment opportunity and anti-harassment and non-discrimination; fairness in the workplace;business practices; antitrust laws; electronic communications and information security; accuracy of books, records and financial statements;confidential information; securities trading; confidentiality; conflictsgovernment investigations; ethics hotline availability; and accountability for adherence to the Code of interest; fairness in business practices; anti-briberyBusiness Conduct and anti-corruption laws; antitrust laws;Ethics and political activities and solicitations.

Statementprompt internal reporting of Ethical Principles any possible violations thereof.

Our Statement of Ethical Principles applies to our directors, officers and employees and is designed to deter wrongdoing and to promote, among other things:

|

|

|

|

|

|

|

|

|

|

|

|

Director Nomination Process

Under our By-laws, stockholders of record are able to nominate persons for election to our Board only by providing proper written notice to our Secretary.Secretary at our address set forth in this Proxy Statement. Proper notice must be timely, generally between 90 and 120 days prior to the relevant meeting (or, in the case of annual meetings, prior to the first anniversary of the prior year’syear’s annual meeting), and must include, among other information, the name and address of the stockholder giving the notice, a representation that such stockholder is a holder of record of our common stock as of the date of the notice, certain information regarding such stockholder’s beneficial ownership of our securities and any derivative instruments based on or linked to the value of or return on our securities as of the date of the notice, certain information relating to each person whom such stockholder proposes to nominate for election as a director and a representation as to whether such stockholder intends to solicit proxies. In addition, in the event a stockholder of record desires to bring any other business before the meeting, proper notice must include a brief description of anysuch other business suchthe stockholder proposes to bring before the meeting and the reason for conducting such business and a representation as to whether such stockholder intends to solicit proxies.business.

The Nominating and Governance Committee will consider director candidates recommended by stockholders. Our By-laws provide that any stockholder of record entitled to vote for the election of directors at the applicable meeting of stockholders may nominate persons for election to our Board, if such stockholder complies with the applicable notice procedures.

Our Corporate Governance Guidelines and the Policy Statement contain information concerning the responsibilities of the Nominating and Governance Committee with respect to identifying and evaluating future director candidates. The Policy Statement sets forth our Nominating and Governance Committee’sCommittee’s general policy regarding the consideration of candidates proposed by stockholders; a description of the minimum criteria used by the Nominating and Governance Committee in evaluating candidates for the Board; a description of the Nominating and Governance Committee’s process for identifying and evaluating director nominees (including candidates recommended by stockholders); and the general process for communications between stockholders and the Board. Spencer Stuart, a national outside director search firm that we retained in 2018, assisted in identifying Ms. Miller, who was elected by the Board in September 2019 and is a nominee for election at the Annual Meeting.

Majority Voting for Directors

Our By-laws provide for majority voting in uncontested director elections, and any incumbent director who fails to receive a majority of the votes cast must submit an offer to resign from the Board no later than two weeks after the Company certifies the voting results. In that case, the remaining members of the Board would consider the resignation offer and may either (i) accept the offer or (ii) reject the offer and seek to address the underlying cause(s) of the majority-withheldmajority-against vote. The Board must decide whether to accept or reject the resignation offer within 90 days following the certification of the stockholder vote, and, once the Board makes its decision, the Company must promptly make a public announcement of the Board’sBoard’s decision (including a statement regarding the reasons for its decision in the event the Board rejects the offer of resignation).

Director Independence

As set forth in our Corporate Governance Guidelines, the majority of directors must be “independent” according to the criteria for independence established by the NYSE. Our Corporate Governance Guidelines also require that all the members of each of the standing committees of the Board (other than the Executive Committee) must be independent, including any enhanced independence standards applicable to a particular committee, and none of the members of the standing committees (other than the Executive Committee) must be independent and may not directly or indirectly accept any consulting, advisory or other compensatory fee (other than pension or other forms of deferred compensation for prior service which is not contingent in any way on continued service) from the Company or its subsidiaries and none of the members of the standing committees may have a material relationship with the Company. In order to determine that a director is independent, the Board must make an affirmative determination that the director satisfies applicable regulatory and NYSE listing requirements to be an independent director of the Company and that the director is free of any other relationship that would interfere with the exercise of independent judgment by such director. The Board has determined that the following directors are independent Naomi M. Bergman, Brad D.independent: Mr. Brian, Thomas S.Mr. Gayner, Deborah J.Ms. Kissire, Alan G. Spoon, Wallace R.Ms. Meduski, Mr. Might (beginning in 2021), Ms. Miller, Ms. Smith, Mr. Weitz and Katharine B.Ms. Weymouth. The Board also determined that prior to his retirement as a member of the Board in February 2021, Mr. Spoon was independent.

Executive Sessions of the Non-Management Directors

The listing standards of the NYSE call for the non-management directors of the Company to meet at regularly scheduled executive sessions without management. Thomas S.Mr. Gayner serves as Lead Independent Director of the Board, and he presides at the executive sessions of the Board. In 2016,2020, the non-management directors regularly met in executive sessions outside the presence of any employee director or management, and the non-management directors expect to meet in executive session in 20172021 as appropriate.

Board Leadership Structure

TheAs set forth in our Corporate Governance Guidelines, the Board supports flexibility in determining its leadership structure by not requiring the separation of the roles of ChairmanChair of the Board and Chief Executive Officer. The Board believes that the Company and its stockholders are best served by maintaining this flexibility rather than mandating a particular leadership structure.

In 2016, Mr. Might served as Chairman of the Board as well as Chief Executive Officer of the Company. Effective January 1, 2017, Ms. Laulis was appointed President and Chief Executive Officer, while Mr. Might continues to serve as Chairman of the Board. Until the separation ofWe currently do not separate the roles in 2017, the Board believed that Mr. Might’s service as both Chairmanof Chair of the Board and Chief Executive Officer wasas Ms. Laulis serves in both roles. The Board believes that Ms. Laulis’ service as both Chair of the Board and Chief Executive Officer is in the best interests of the Company and that this structure wasis appropriate because Mr. MightMs. Laulis possesses in-depth strategic and operational knowledge of the opportunities and challenges facing the Company and has played a critical role in the growth of the Company during his over-20 years of experienceher more than 20-year career at Cable One through her experiences as an employee, executive at and as a memberdirector of Cable One. Her dual role promotes decisive leadership, accountability and clarity in the overall direction of the Company’s business strategy as well as effective decision-making and strategic alignment between the Board of Cable ONE.

We currently maintain separate roles between Chairmanand the Company’s senior management. The Board also believes that this approach facilitates clear and consistent communication of the Board Company’s strategy to all stakeholders and Chief Executive Officerthat, in recognition of the differences between the two responsibilities and because we believe that, at this time, the separation of the roles is in the best interests of the Company. This structure is appropriate becauseconsultation with our Chief Executive Officer,Lead Independent Director, Ms. Laulis is responsible for, among other things, setting our strategic direction and day-to-day leadership and performance of our Company. Meanwhile, Mr. Might continuesbest positioned to serve as an executive officer of the Company. As Chairman of the Board and Executive Chairman, Mr. Might focuses on strategy and business development, provides input to the Chief Executive Officer, developsdevelop agendas that focus on matters that merit Board attention, and presides over meetings of the full Board.attention.